how do you calculate cash flow to creditors

Creditors interest paid net new borrowing. Just look at the amount of money that you are owed plus the amount of the debt you are in debt to the creditor.

Debtors And Creditors Control Accounts Accounting Basics Financial Peace University Accounting

Creditors have interest in your operating cash flow when deciding whether you are well-positioned to take on additional debt.

. The formula of cash flow to. Creditors interest paid net new borrowing. The formula of cash flow to.

Heres how to calculate the cash flow from assets. Bettys Blooms Flower Shops had a -26500 cash flow from assets from July to. Ad The Leading Online Publisher of National and State-specific Legal Documents.

The formula of cash flow to creditors interest paid - net new borrowing. Creditors interest paid net new borrowing. The formula of cash flow to.

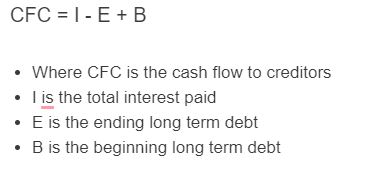

Creditors interest paid net new borrowing. While the exact formula will be different for every company depending on the items they have on their income statement and balance sheet there is a generic cash flow from. Cash Flow to Creditors I - E B.

18500 -15000 -30000 -26500. Ad QuickBooks Financial Software. E Ending Long Term Debt.

There are two different methods that can be used to. Basic Formula The basic formula for operating cash. The direct method is exactly what it sounds like a direct way of calculating operating cash flow by deducting the total amount of cash expenses from the total amount of cash receipts.

Net new borrowing asks for ending. Ad Cash Flow Forecast Spreadsheet Templates for Business. Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital.

Net new borrowing asks for ending. The formula of cash flow to. How do you calculate cash flow to creditors if you are not given long term debt.

How do you calculate cash flow to creditors if you are not given long term debt. Net new borrowing asks for ending. How do you calculate cash flow to creditors if you are not given long term debt.

This is a lot easier to calculate than it sounds. How do you calculate cash flow to creditors if you are not given long term debt. How do you calculate cash flow to creditors if you are not given long term debt.

Since so many transactions involve non-cash items you have to alter how you calculate their effect on cash flow. Where I Interest Paid. Cash Flow Templates for Excel Open Office Google Sheets More.

B Beginning Long Term Debt. The simple formula above can be built on to include many different items that. Where I Interest Paid E Ending Long Term Debt B Beginning Long Term Debt.

Equation for calculate cash flow to creditors is Cash Flow to Creditors I - E B. Rated the 1 Accounting Solution. Get Access to the Largest Online Library of Legal Forms for Any State.

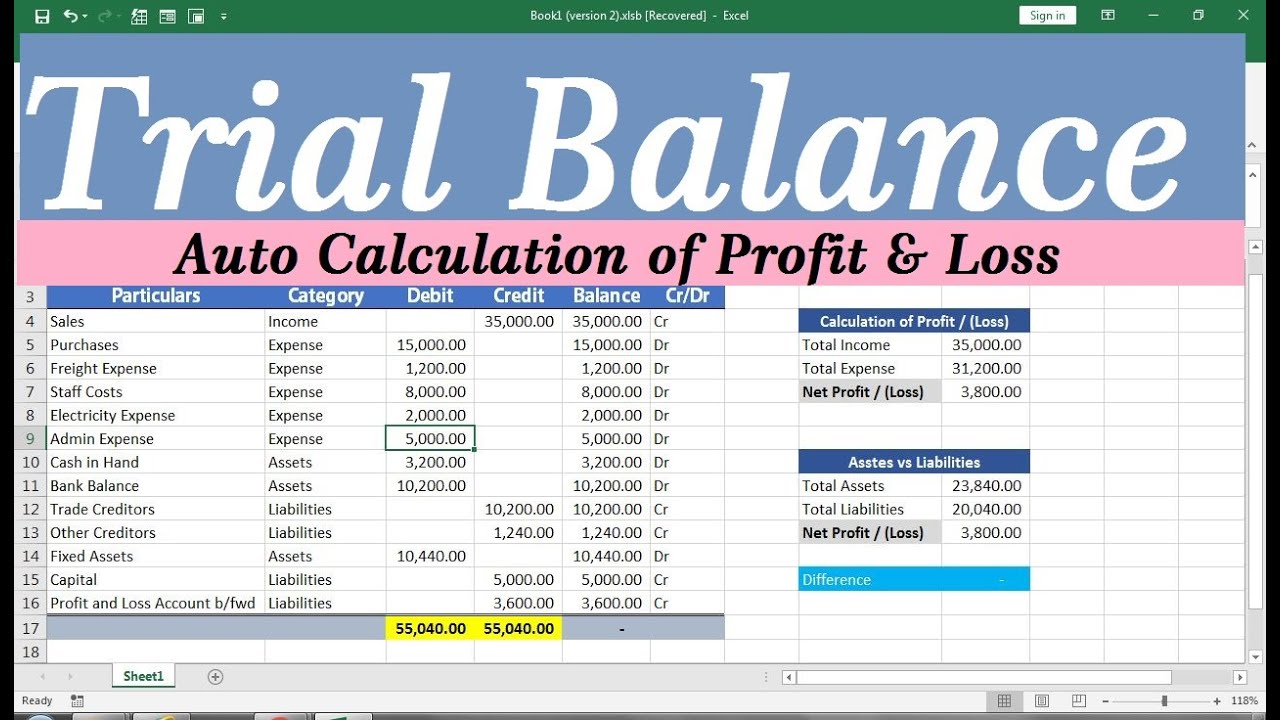

How To Make Profit And Loss Account And Balance Sheet In Excel Balance Sheet Trial Balance Balance

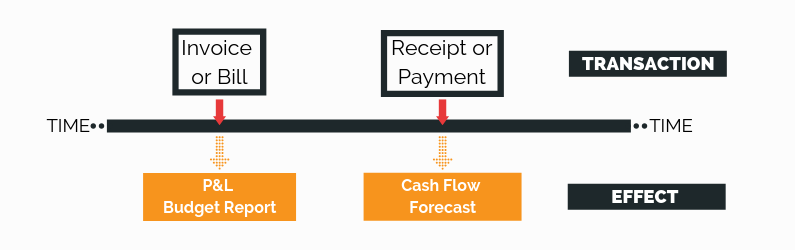

Timing Of Debtor And Creditor Payments Calculation In Calxa

Cash Flow To Creditors Calculator Calculator Academy

Account Payable Vs Accrued Expense Top 6 Differences To Learn Accounts Payable Accounting Basics Accounting

Blank Income Statement Template Fresh Blank In E Statement And Balance Sheet Aoteamedia Statement Template Income Statement Mission Statement Template

Debtors Ledger Accounting Basics Accounting Creditors

The Accounting Equation Is The Best Methods In Principle Of Accounting Accounting Learn Accounting Accounting Basics

Creditor Payables Days Tutor2u Business Financial Ratio Small Business Tools Resume

How To Prepare Projected Balance Sheet Accounting Education Balance Sheet Accounting Education Accounting Principles

Cash Flow To Creditors Calculator Calculator Academy

Cash Flow Or Budgeted Cf Report Template Free Report Templates Cash Flow Statement Cash Flow Budgeting

Branches Of Accounting Accounting Jobs Bookkeeping Business Accounting Education

Training Financial Modeling Fundamentals Working Capital Debtors Modano

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)